An Educative Guide to Preserving Wealth Across Generations

For many investors, building wealth is only part of the goal. The true measure of financial success lies in what happens after you’ve accumulated it, how it’s preserved, distributed, and remembered.

Securing your financial legacy requires more than just a will or naming a beneficiary. It demands a thoughtful estate plan, smart structuring, and the strategic use of tools like trusts. Whether you’re looking to support your family, fund charitable causes, or ensure business continuity, the choices you make today will echo for generations.

At Axenith Capital, we believe legacy planning is a crucial, and empowering, part of your wealth journey. In this guide, we’ll walk you through the core elements of securing your legacy, demystify often misunderstood terms, and offer practical insights for effective estate planning.

Why Legacy Planning Matters

Wealth, when well-managed, has the power to provide for loved ones, shape opportunities, and reflect your values long after you’re gone. Yet too often, families lose wealth due to poor planning, tax missteps, or unclear directives.

Legacy planning ensures:

- Your assets go to the right people, at the right time, under the right terms

- Estate taxes and legal complications are minimized

- Your values and wishes are honored with clarity

- Family conflict is reduced through transparent communication and documentation

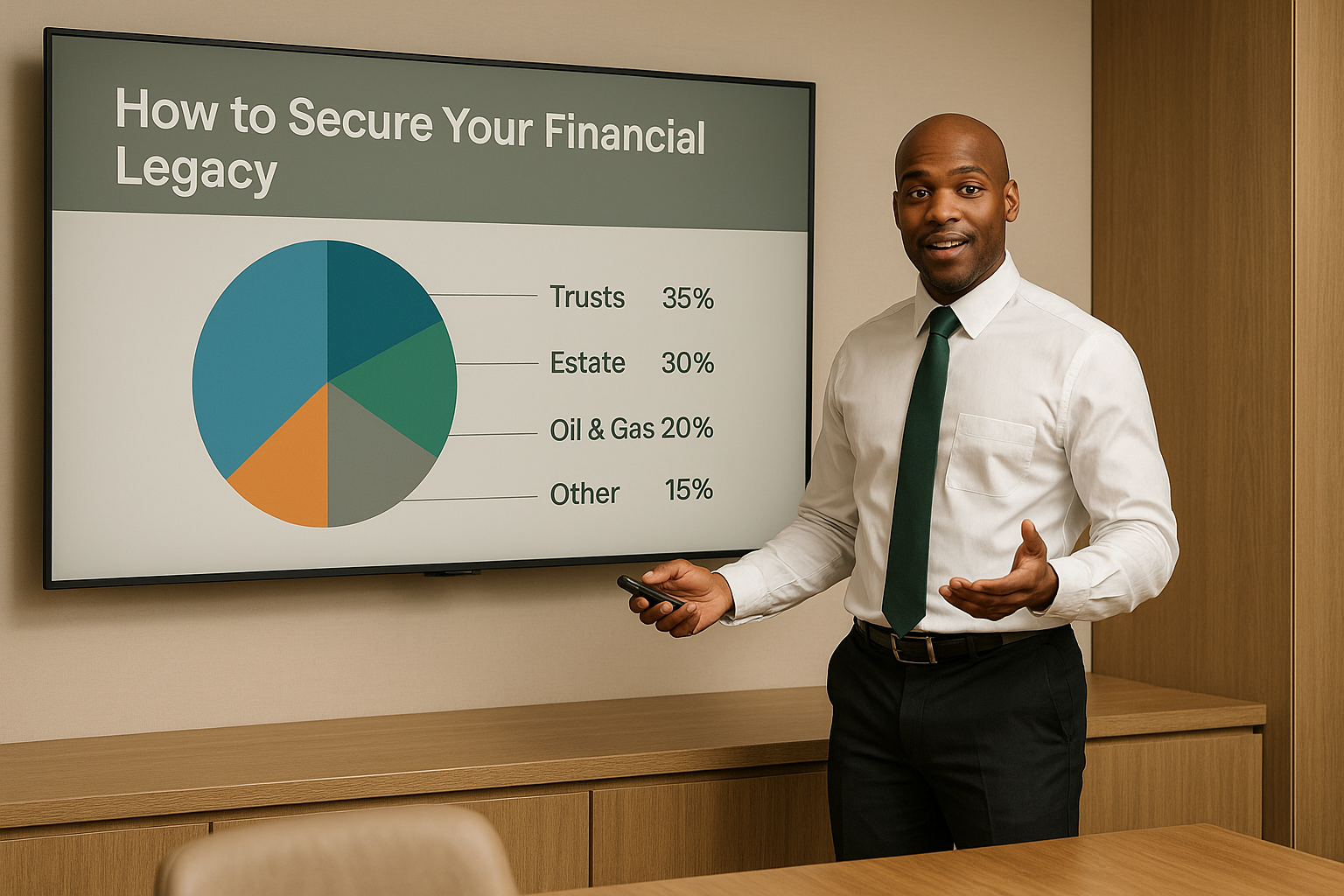

Key Tools for Securing Your Financial Legacy

Let’s explore the most essential components of a robust estate and legacy plan:

1. Estate Planning: More Than Just a Will

An estate plan is a comprehensive strategy for managing and distributing your assets upon death or incapacitation. At its core, a well-crafted estate plan should include:

- A Last Will and Testament – Specifies how your assets should be distributed and who will care for minor children (if applicable).

- Durable Power of Attorney – Appoints someone to manage your financial affairs if you’re unable to do so.

- Healthcare Proxy / Living Will – Provides guidance on medical decisions if you become incapacitated.

- Asset Inventory – A detailed listing of everything you own: real estate, investments, retirement accounts, life insurance, digital assets, etc.

Many people overlook estate planning until it’s too late. But creating a plan early and reviewing it regularly (especially after major life events) is one of the most protective financial steps you can take.

2. Trusts: The Engine of Control and Continuity

A trust is a powerful estate planning tool that allows you to transfer assets to a trustee who manages them for the benefit of your chosen beneficiaries. Unlike a will, trusts can be activated during your lifetime and can provide benefits immediately, or at a set point in the future.

Common Types of Trusts:

- Revocable Living Trust – Offers flexibility to change terms while you’re alive; avoids probate.

- Irrevocable Trust – Cannot be altered once established; useful for reducing estate taxes and protecting assets.

- Charitable Trust – Used to support philanthropic goals while gaining tax benefits.

- Special Needs Trust – Designed for beneficiaries with disabilities to ensure continued care without affecting eligibility for benefits.

Trusts offer privacy, tax advantages, and precise control over how and when your assets are distributed.

3. Beneficiary Designations: Simple but Critical

Many assets, like retirement accounts, life insurance, and brokerage accounts, allow you to name direct beneficiaries. These designations override your will, so keeping them up to date is vital.

Review them after any major life event (marriage, divorce, births, or deaths), and ensure they align with your overall estate plan.

4. Gifting Strategies & Tax Efficiency

If your estate is large, strategic gifting during your lifetime can reduce your taxable estate while supporting loved ones. The IRS allows annual tax-free gifts up to a certain limit per recipient (currently $17,000 per individual, per year as of 2025).

Larger gifts, charitable donations, and family trusts can be structured to minimize tax burdens while maximizing impact.

5. Business Succession Planning

For business owners, the legacy includes not just personal assets but the continuity of the enterprise. A detailed succession plan outlines who will lead, own, or sell the business in your absence, ensuring stability and honoring your vision.

Tools may include:

- Buy-sell agreements

- Key person insurance

- Family governance structures

How Axenith Capital Helps You Build and Preserve Legacy

Legacy planning isn’t a one-time event, it’s a strategic, evolving process. At Axenith Capital, we partner with clients to:

- Evaluate current estate plans and identify gaps

- Collaborate with legal and tax professionals to structure efficient solutions

- Educate heirs and future generations on responsible wealth management

- Align legacy planning with investment strategy and life goals

Our holistic approach integrates estate planning into your broader financial life, ensuring your legacy isn’t left to chance.

Final Thoughts: Leave More Than Money; Leave a Message

Your legacy is more than wealth, it’s your values, your story, your vision for the future. Whether you want to support your family, protect a business, or give back to society, the time to plan is now.

Let’s Build Your Legacy, Together

At Axenith Capital, we guide individuals, families, and entrepreneurs through every phase of legacy planning with care, precision, and foresight.

Schedule a personalized consultation today to begin crafting a plan that protects what you’ve built, and honors who you are.