In the world of investing, risk and reward are two sides of the same coin. Every investment decision, whether bold or conservative, exists somewhere on the spectrum between potential gain and possible loss. Understanding how to balance these two forces is not just a theory; it is the very foundation of smart portfolio construction.

At Axenith Capital, we believe that an informed investor is an empowered investor. This guide is designed to help you grasp the practical relationship between risk and reward, and how to use that knowledge to make decisions that align with your goals, time horizon, and tolerance for uncertainty.

What Is “Risk” in Investing?

Risk, in simple terms, is the possibility that an investment will yield a different outcome than expected, usually in the form of lower returns or even a loss of capital. But not all risks are created equal. Here are a few types you should know:

- Market Risk: The risk of prices fluctuating due to market dynamics.

- Inflation Risk: The danger that inflation will erode your purchasing power over time.

- Interest Rate Risk: Especially relevant in bonds, when rates rise, bond prices fall.

- Liquidity Risk: The chance that you may not be able to sell an asset quickly without significant loss.

- Credit Risk: The risk that a bond issuer or borrower will default on obligations.

Understanding the type and magnitude of risk tied to an asset class helps you make informed decisions, not based on fear or hype, but on facts and alignment with your financial goals.

What Is “Reward”?

Reward is the potential gain or return you expect from your investment, usually expressed as capital appreciation, income (like dividends or interest), or both.

Typically, the higher the potential reward, the greater the risk involved. That’s why ultra-safe assets like Treasury bills offer low returns, while volatile assets like emerging market stocks or cryptocurrencies can deliver high gains, but at greater risk.

The Risk-Reward Tradeoff: The Core of Portfolio Strategy

A smart portfolio doesn’t aim to eliminate risk, it aims to optimize it. This is where the concept of the risk-reward tradeoff comes in:

Every investment decision involves balancing the level of risk you’re willing to accept with the level of return you hope to achieve.

At Axenith Capital, we help clients define this balance clearly through a framework that considers:

- Time horizon

- Financial goals

- Income needs

- Emotional comfort with volatility

- Overall financial health and stage of life

We translate this into a personalized investment strategy that manages risk while targeting realistic and sustainable returns.

How to Build a Smart, Risk-Adjusted Portfolio

Let’s walk through how investors, at any stage, can structure a smart portfolio using the principles of risk vs. reward.

1. Define Your Objectives Clearly

Are you investing for retirement in 20 years or buying a home in five? Do you need income today, or are you building long-term wealth? Your investment goal is your compass, everything else follows.

2. Know Your Risk Tolerance

Some investors lose sleep when the market dips 3%. Others see it as a buying opportunity. Knowing your comfort level with volatility helps determine your ideal asset mix. At Axenith, we use guided risk assessments and real-time portfolio modeling to help clients make confident decisions.

3. Diversify Thoughtfully

Diversification is not about owning a little of everything, it’s about blending asset classes that behave differently in various market conditions. Stocks, bonds, real estate, and alternatives can all play strategic roles. A diversified portfolio lowers overall risk while preserving the opportunity for solid returns.

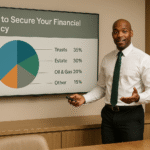

4. Use Asset Allocation as a Tool, Not a Trend

Your asset allocation, the mix of equities, fixed income, cash, and alternatives, is the single biggest driver of portfolio performance and risk profile. Rebalancing it regularly ensures your strategy stays aligned with your evolving goals and market conditions.

5. Think Long-Term, Act with Discipline

Short-term market fluctuations are inevitable. Smart investors don’t chase trends, they trust their strategy and stay the course, making adjustments when necessary but always guided by long-term thinking.

How Axenith Capital Helps You Navigate Risk Intelligently

We don’t just build portfolios, we build trust through education, personalized strategy, and disciplined execution. Here’s how we stand out:

- Tailored Portfolio Design: No one-size-fits-all approach. Every portfolio reflects your goals and values.

- Risk Management Frameworks: We use robust risk modeling tools to anticipate market volatility and adjust your allocation when needed.

- Ongoing Education: We equip you with knowledge, through regular briefings, performance reviews, and timely market insights.

- Curated Alternatives for Strategic Diversification: For qualified investors, we provide access to high-quality alternative assets that balance traditional risks and enhance long-term reward potential.

In Conclusion: Risk Isn’t the Enemy; It’s the Pathway to Reward

Smart investing isn’t about avoiding risk, it’s about understanding, managing, and using it to your advantage. The key is to align every investment decision with your specific goals, time horizon, and comfort with uncertainty.

At Axenith Capital, we guide clients through every step of that process, bringing clarity to complexity, discipline to decision-making, and confidence to the long-term journey.

Ready to Build a Smarter Portfolio?

Whether you’re just starting or refining your existing strategy, we’re here to help. Schedule a conversation with an Axenith Capital advisor today and discover how intelligent risk management can unlock meaningful, sustainable growth for your future.