Investing is one of the most powerful paths to building long-term wealth. But as with any meaningful journey, the path is often littered with missteps, especially for beginners. At Axenith Capital, we believe that education is the antidote to uncertainty. Whether you’re stepping into the world of investments for the first time or guiding someone who is, understanding common mistakes and how to avoid them is vital.

Here are the top 10 mistakes new investors often make, and what you can do instead to chart a more confident, successful course.

1. Investing Without Clear Goals

The Mistake: Many new investors start investing just because they’ve heard it’s “the smart thing to do,” without defining why they are investing.

The Fix: Set specific, measurable financial goals, whether it’s retirement at 60, buying a home, or building generational wealth. Your goals will determine your time horizon, risk tolerance, and the types of assets you should consider.

2. Following the Herd

The Mistake: Jumping on trending stocks, meme assets, or hyped markets without understanding them.

The Fix: Do your research or partner with a firm like Axenith Capital, where decisions are driven by data, not drama. Investment success is often a result of thoughtful strategy, not viral trends.

3. Neglecting Diversification

The Mistake: Putting all your money into one stock or asset class (e.g., tech stocks or cryptocurrency).

The Fix: Diversify across sectors, geographies, and asset classes, including equities, bonds, real estate, and alternative investments. Diversification reduces risk and provides a more stable long-term return.

4. Trying to Time the Market

The Mistake: Waiting for the “perfect moment” to invest, or trying to predict market highs and lows.

The Fix: Focus on time in the market, not timing the market. Use a dollar-cost averaging approach, where you invest fixed amounts regularly. Markets are cyclical, consistency wins over guessing.

5. Ignoring Fees and Costs

The Mistake: Overlooking how fees, commissions, and fund expenses eat into returns.

The Fix: Understand the fee structures of your investment vehicles. At Axenith Capital, we prioritize transparent fee models to ensure clients know exactly what they’re paying for, and why.

6. Letting Emotions Drive Decisions

The Mistake: Panic-selling during market dips or greedily chasing returns during rallies.

The Fix: Have a well-structured investment plan and stick to it. Remember: volatility is normal. Partnering with a disciplined advisor helps you remain level-headed.

7. Overestimating Risk Tolerance

The Mistake: Claiming to be a “high-risk” investor, until the market dips and panic sets in.

The Fix: Be honest about your comfort level with risk. Your advisor can help match you with a portfolio that aligns with both your goals and emotional bandwidth.

8. Underestimating the Power of Compound Interest

The Mistake: Thinking small investments now won’t amount to much.

The Fix: Start early, even if the amount is modest. The longer your money stays invested, the more it compounds. Time, not timing, is your greatest ally.

9. Not Rebalancing the Portfolio

The Mistake: Setting up your portfolio once and forgetting about it.

The Fix: Markets shift, and so should your allocations. Regular portfolio reviews (at least annually) help you stay aligned with your goals and risk profile. At Axenith Capital, this is part of our ongoing portfolio stewardship.

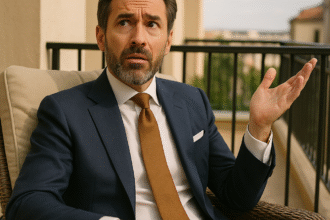

10. Going It Alone

The Mistake: Trying to navigate the increasingly complex world of investing without guidance.

The Fix: Leverage the experience of trusted financial professionals. At Axenith Capital, we offer more than just investment advice, we deliver holistic, strategic wealth planning, tailored to your life journey.

Final Thoughts

Investing isn’t just about chasing returns, it’s about building a meaningful financial future. Every mistake is a learning opportunity, but you don’t have to learn them all the hard way. At Axenith Capital, we’re committed to guiding you with clarity, empathy, and a strategy that evolves with you.

Let’s transform uncertainty into confidence, and dreams into reality.

Start your journey with Axenith Capital today.

Smart investing begins with smart guidance.