In the fast-evolving world of wealth management, one truth remains unchanged: retirement is no longer a destination, it’s a new chapter. For many, the goal has shifted from merely accumulating wealth to generating sustainable, reliable income that lasts a lifetime.

At Axenith Capital, we understand that financial independence doesn’t come from a single decision, but from a well-orchestrated strategy that balances growth today with stability tomorrow. Whether you’re in the prime of your career or approaching your golden years, the right income strategy can be the bridge between ambition and peace of mind.

Here’s how to build, and maintain income streams for life.

1. The Retirement Dilemma: Growth vs. Security

Many investors face a tug-of-war: they want their money to grow, but also need predictable income to cover essential expenses in retirement. Relying solely on market performance introduces uncertainty, while keeping assets too conservative may not keep pace with inflation.

The solution? A hybrid approach. One that blends growth-oriented investments with steady income-generating assets, tailored to your lifestyle needs and time horizon.

2. Strategic Income Layering: A Proven Framework

At Axenith Capital, we employ a layered income strategy, a method that segments assets based on your near-term and long-term income needs.

- Essential Income Layer:

This covers non-negotiables like housing, healthcare, and daily living. We recommend secure, predictable sources such as:

- Fixed-income annuities

- Government and high-grade corporate bonds

- Social Security optimization strategies

- Lifestyle Income Layer:

For discretionary spending, travel, leisure, gifting , we include:

- Dividend-paying stocks

- REITs (Real Estate Investment Trusts)

- Business or royalty income streams

- Growth Layer:

Designed to outpace inflation and replenish your income layers over time, this portion includes:

- Equities and ETFs in growth sectors

- Alternative assets (e.g., private equity, venture capital, infrastructure)

- Tax-efficient managed portfolios

This method ensures your essentials are covered while your portfolio continues to grow, giving you both security and freedom.

3. Don’t Outlive Your Money: Longevity Planning

Thanks to advances in healthcare, many retirees today are living well into their 90s. That’s great news, but it also introduces the risk of outliving your savings. Our planning models at Axenith Capital incorporate advanced longevity simulations, designed to account for market volatility, healthcare costs, inflation, and potential long-term care.

Through lifetime income products and adaptive withdrawal strategies, we help our clients retire with confidence, not concern.

4. Tax Efficiency: Keep More of What You Earn

Generating income is only half the battle, keeping it matters just as much. We help our clients structure withdrawals and asset placements to reduce tax drag, using tools like:

- Roth conversions

- Tax-loss harvesting

- Municipal bond ladders

- Strategic asset location (taxable vs. tax-deferred vs. tax-free accounts)

These strategies can significantly extend the life of your portfolio.

5. Personalization: The Axenith Capital Advantage

There’s no one-size-fits-all solution in retirement. Your goals, risk tolerance, family needs, and legacy aspirations are uniquely yours. That’s why our advisors don’t just offer portfolios, they build comprehensive financial blueprints that adapt with your life.

We’re not just your investment manager, we’re your long-term partner, offering:

- Real-time financial monitoring

- 24/7 client support

- Quarterly strategy reviews

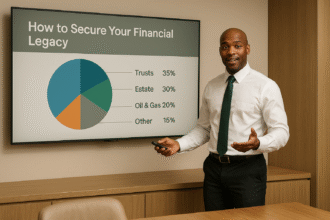

- Estate and legacy planning integration

6. New Age Income Sources: Thinking Beyond the Traditional

We also help clients tap into modern income opportunities such as:

- Energy royalties

- Private lending

- Fractional real estate ownership

- Digital assets (carefully selected and vetted)

With the right guidance, these vehicles can offer significant passive income without excessive risk.

Final Thoughts: Your Income, Your Independence

Building a retirement plan that balances growth and stability isn’t just about numbers, it’s about creating a life of freedom, fulfillment, and security. At Axenith Capital, we take the guesswork out of retirement income planning, using time-tested strategies, modern tools, and a deeply personalized approach to help you thrive in every season of life.

Let’s design your income for life and your legacy beyond it.

Ready to start your journey?

Schedule your complimentary retirement income consultation with Axenith Capital today.

© Axenith Capital – All rights reserved.